- Comprehensive Insurance is an Insurance Policy that is designed to cover various material and physical damages, which may occur to your vehicle. These damages includes losses, damages or any future accidents to which your car or its parts may be exposed to. The maximum coverage of your insurance can be up to 100% of its agreed value.

-

• Known accidents – Accidents with two or more parties mentioned in the police report.

• Unknown accidents – Accidents without a second party or a non-living entity (i.e. a sidewalk, wall, pothole, etc.…

• Windshield. – Cracks and breakage to the windshield are covered.

• Fire – Total loss or partial fire damages to the vehicle.

• Theft – Total theft or partial of parts of the vehicle.

- In-agency repair for cars less than 5 years old

- Deductible to be applied: based on the price of car and the class of the car (Sports car, commercial vehicles , Saloon, etc.) for further enquiries contact phone No. 1802080

- There is no depreciation percentage on spare parts

- In-agency windshield replacement (Once without deductible)

- Coverage of unknown accidents: 10% of the car value for a maximum of KD 1000 and 50% of the excess shall be borne by the insured

- Coverage of wheel rims and tyres in the event of a known accident is covered by 100%. But for unknown accident, 50% is covered.

Note: Kindly call the contact centre of the Gulf Insurance Group at 1802080 for any inquiries.

In the event your vehicle is considered a total loss; for known accident, the depreciation schedule or market value of the vehicle, whichever is less, shall be applied.

Depreciation schedule:

• 5% of the insurance sum (1-3 months)

• 10% of the insurance sum (4-6 months)

• 15% of the insurance sum (7-9 months)

• 20% of the insurance sum (10-12 months)

For unknown accidents: the unknown clause shall be applied.

In the event of theft or fire: the vehicles declared value shall be compensated according to its market value or insurance value whichever is less, for a maximum of 75% of the car value. In the event of known and unknown accident, the unknown clause shall be applied.

Note: these clauses and conditions are subject to change. Therefore, contact phone No.1802080 for the latest clauses and conditions. You can also refer to the booklet or the smart phone application.

-

- By contacting the call centre via 1802080

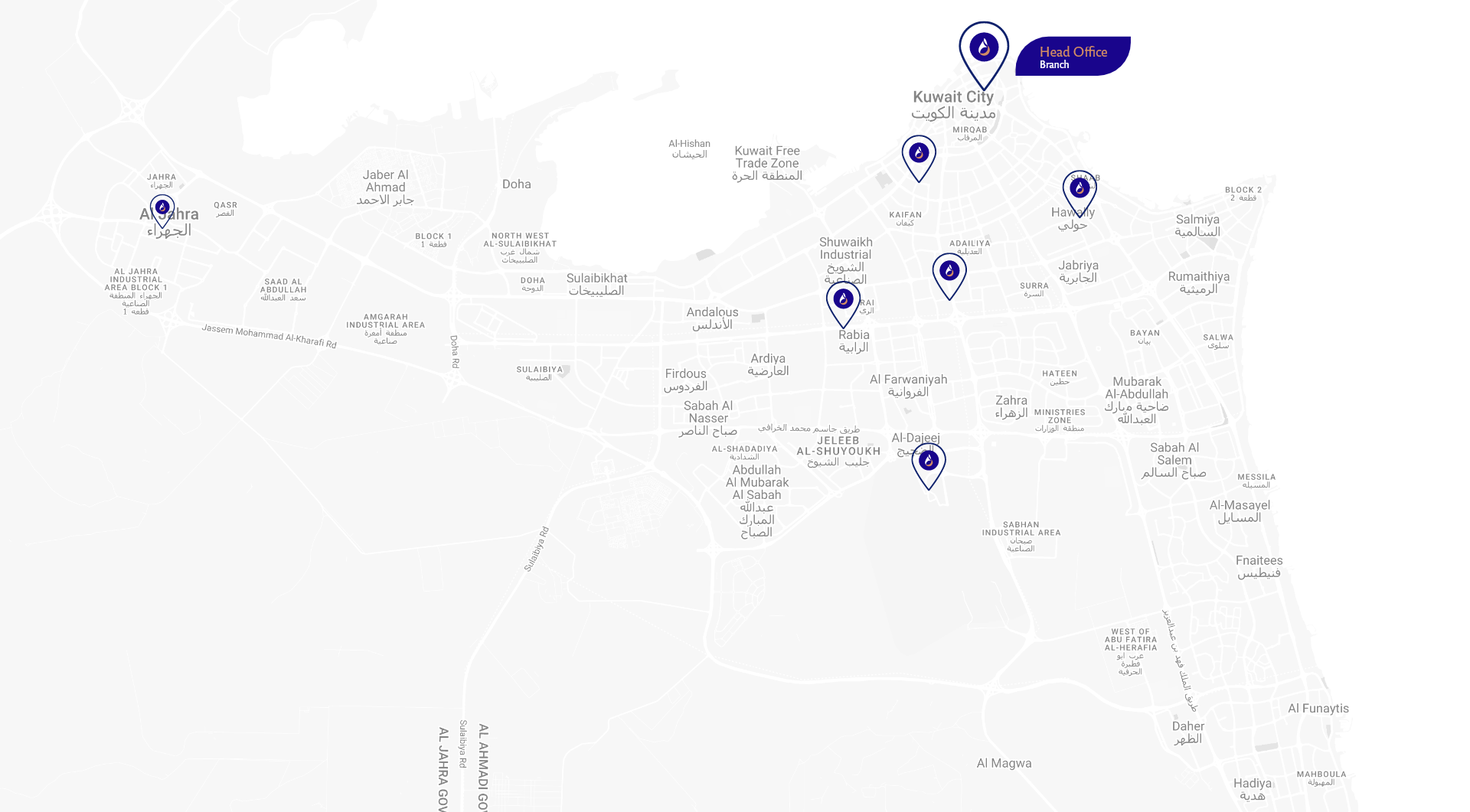

- By visiting us at the head office or any of the GIG branches

- Through the website or mobile application.

- The car manufacturing date shall not exceed 5 years.

- Vehicles older than 5 years can be insrured if their insurance was continuous from the previous years.

- The car should not have been involved in accidents during the insurance period.

-

- The premium is calculated based on the type of the car (Sports car, Pickup Truck, Saloon, etc.), its manufacturing date, and market value

- The minimum value for comprehensive insurance is KD 200 inside the agency and KD 150 outside the agency

- A 4% fixed percentage is applied for cars of value less than KD 10,000

- A 3.5% fixed percentage is applied for cars of value more than KD 10,000

-

- Copy of the Civil ID

- Vehicle registration

- The clients contact details

- Inspection of the car prior to issuing

-

- Vehicle was not subject to any claim

- policy Cancelation is based on an 8 months period:

1- In case of cancelation before 8 months , the refund will be based on the remaining months from the basic premium (provided that there are no claim)

2- In case of cancelation after 8 months, no refund is entitled

- If any claim is found , cancelation will be completed without any refund

- The cancelation can only take place at the Head Office

-

- The client can intimate the claim through the GIG application, Email, call center or Whatsapp.

- The insured can visit the company to inspect the accident

- A file shall be opened for the accident by the insured or his attorney with submission of all documents.

- The estimation request can be given to the client to refer to the agency garage for repair.

- The client may go directly to the dealership where they can send an email on their behalf

- For most cases the vehicle is released with the approval of the estimation provided by the dealership/garage

- A maximum of 20 days can be arranged

- You do not need a police report (accident report) in the event of replacement of the windshield.

- Third Party Insurance is an insurance policy that is mandatory by Kuwait, it is designed to provide coverage to accidents the insured may cause

-

- Copy of the civil ID

- Copy of the Vehicle registration

-

- By visiting the Head office of the Group.

- By visiting www.gig.com.kw

- Through the smart phone application GIG Kuwait.

- By visiting any of Our branches present in the State of Kuwait.

-

- Refer to the head office for cancellation.

- Vehicle Registration

-

- 2 passenger cars = KD 18.500.

- 4 passengers cars = KD 19.500.

- 5 passengers cars = KD 20.

- 6 passengers cars= KD 20.500

- 7 passengers cars = KD 21.

- Private pick up 2 passengers = KD 23.

- Private pick up 4 passengers = KD 25.

-

- Obtaining a police report (accident report) (3 pages.) with the party at fault clearly defined

- Visiting Gulf Insurance Group head office.

- Visiting an approved garage within the Gulf Insurance Group’s network and opening the file through them

- Providing the documents at the head office.

- Wait for verification of the submitted documents.

- Obtain a “notice of no claim paid” from your insurance company

- Obtain a date for receiving compensation.

-

The policy is delivered during the official working days of the Company through the Company’s messengers or by visiting one of our branches.

-

The head office should be visited for amendment; Old policy must be presented as well.

- For new insurance requests:

• Contact via email : motoruw@gig.com.kw

• GIG Application

• GIG Website

• Contacting the call center via 1802080

• Contact Via whatsapp 62221102

- For new claims requests:

• Contact via email : motorclaims@gig.com.kw

• GIG Application

• GIG Website

• Contacting the call center via 1802080

• Contact Via whatsapp 62221102

- • Medical insurance covers the insured member in private centers and hospitals.

- • There are different plans with different financial limits and geographical territories.

- • For inquiries, please call: 1802080

- The price depends on the age, gender and application form submitted.

- • Please , contact us on 1802080.

- • The client will be contacted and the insurance application will be handed over to the client in order to fill it.

- • The filled insurance application will be submitted to the concerned department, which will review the application and will submit the suitable offer to the client.

- • You can visit any of the Medical providers in the network approved by the company.

- • Submit to the medical provider the insurance card and the CID.

- • Provider will send all required documents to the insurance company order to get approval.

- • Approvals team will review the request based on the terms of the policy.

- • The maximum waiting period for medical claim evaluation is 30 minutes.

- Please provide us with your complain, the policy number and the CID and share it with us through either :

- - Sending an email to customer.Ser@GIG.com.kw

- - Or Call or WhatsApp 1802080.

- • Reimbursement is covered only for Non approved Network providers.

- • Usual and Customary rates in the approved network will be applied.

- • Related documents should be submitted in GIG main office within maximum 30 days from receiving the treatment for FAY policies and within maximum 60 days from receiving the treatment for AXA policies.

- • Once the documents have been reviewed, you will be informed about the status of your claim.

- • You can ask about the claim status by calling our customer service on 1802080.

- All treatments for pre-existing conditions, related symptoms, or any condition resulting from or related to a pre-existing condition will not be covered.

- Medications for chronic conditions have a waiting period of 12 months, however, that pre-existing conditions will not be covered.

- Because there is waiting period for dental treatment which is 3 months, subject that your policy covers dental treatment.

- • Renewal can be made by calling 1802080.

- • Or Visit our main office or one of our branches.

- • Or Contact your sales representative directly.

- The period of time starting from the Enrollment Date of the INSURED during which a specific general Health Condition shall not be covered under this Insurance Policy.

- Click here to find out more.

- Click here to find out more.

- It is an insurance that can be added to your local insurance to benefit from coverage outside Kuwait.

- Territories of coverage are Regional, International, and Global.

- • Inpatient only with an annual aggregate limit of 50,000 K.D or 100,000 K.D.

- • Inpatient and Outpatient with an annual aggregate limit of 50,000 K.D or 100,000 K.D.

- By reimbursement, whether inside or outside the approved network.

- • The claim must be completed and signed by the treating doctor and stamped by the Medical provider.

- • Original invoices should be attached to the claim.

- • Copy of ASFAR medical card.

- • Copy of the Group Medical Card and if it’s not available copy of the Civil ID card.

- • All papers must be submitted to the head office.

- • The submission should be not later than 60 days from the date of treatment.

- The claim will be processed within 21 days of submission.

- • You must contact the Medical Approvals Department to obtain approval for this procedure.

- • Claims must be submitted within 60 days from the date of treatment.

- • Compensation will be made up to approximately 80% of usual and customary charges in the country of treatment, taking into account the existence of copayment on some treatments if it is available in the claim.

- • In case of an emergency, you can visit the nearest medical provider, but you must inform us within 48 hours from the admission.

- Long-term investment plans with accumulating annual returns.

- Provide insurance protection if selected in the policy.

- Flexible payment of policy installments (single payment-monthly - quarterly - semi-annual - annual).

- Contact us 1802080

- An insurance request will be created and contacted by the competent employee.

- By visiting and registering on our website at www.clickgic.com

- • Visit our branch at the head office.

- • By calling us at 1802080.

- Yes, the policy can be liquidated after two years and before the policy expiration date.

- Yes, you can.

- It is not possible to take a loan on a Thokhour policy.

- It is a mandatory insurance policy issued by the Srilankan Embassy in the State of Kuwait.

- The annual policy value is 30 KD.

- Two years.

- In the event of death before the end of the insurance date, the insured will be compensated with a maximum of KD 2,000.

- The heirs.

- • Compensation in case of permanent disability resulting from an accident.

- • Compensation in case of partial and permanent disability due to an accident.

- • Returning the remains of the insured to the mother country.

- • Bear all the expenses of emergency medical expenses.

- • bear the legal costs.

- The document should be delivered during the official working days of the company through the company's correspondents or by visiting one of our branches.

- • The headquarters of the amendment is visited

- • Bring the old document

- Yes, all of our travel insurance plans are fulfilling visa requirements.

- No, Travel insurance is designed to cover travelers after leaving their home country (Kuwait).

- Covered Medical Expenses mean Reasonable and Customary Charges incurred during a Trip by the Insured Person for services and supplies which are recommended by an attending Physician/Hospital.

- All residents of Kuwait.

- This insurance cannot be obtained if he/she is outside of Kuwait.

- • Travel duration

- • Insurance plan (Silver, Gold, Platinum)

- • Family/Individual

- • Age

- Age affects the pricing of the insurance policy as per below:

- • From 3 months to 69 years, the price will be the same without an increase

- • From 70 years to 75 years, the price will be increased by 100% (only Silver plan)

- This is the deductible of each and every Loss payable by the Insured Person.

- Yes, Scope of Coverage: Worldwide (excluding Afghanistan, Iraq, Cuba, Iran, Syria, Crimea region, Donetsk People’s Republic (DNR), Luhansk People’s Republic (LNR), North Korea, and Country of Residence)

- Yes, but children must be under 18 years old.

- Travel Insurance can be canceled if the insured got a visa rejection from the embassy.

- • For general inquiries about travel insurance you may contact us at: Phone: +965-1811110 Fax: +965-22961833 E-mail: travel@gig.com.kw Working Hours: Sunday to Thursday from 08:00 to 15:00

- • For Medical Emergency support during the instured trip you may contact AIG MEA Ltd global assistance number +1 817 826 7276 and quote your policy number for assistance 24/7.

- A Home Insurance policy will safeguard you from suffering financial setbacks at the time of an unforeseen accident, by providing you with complete protection for yourself, your family, and your home.

- • Fire and lightning

- • smoke

- • Explosion of pipes and electrical extensions

- • Robbery by force

- • Civil responsibility

- • You can contact us at 1802080

- • The insurance application will be submitted to be filled and returned to us

- • Some documents require a building inspection before they are issued

- No, some valuables must be declared and recorded in the document.

- This is because the insurance policy does not cover travel for more than 45 days.

- If all other policy conditions are met - such as listing the proximate cause, there will be covered depending on the applicable policy type.

- Yes, the value of the item must be proven in the purchase invoice.

- Yes, it goes back to the same percentage that the insured insures.

- Yes, you can buy it.

- It is the legal liability coverage for boats towards other parties.

|

Limit of Liability in Kuwaiti Dinar |

Annual Premium Charges |

Boat |

10,000 KD |

14 KD |

30,000 KD |

25 KD |

|

50,000 KD |

34 KD |

|

100,000 KD |

66.500 KD |

|

Jet ski |

10,000 KD |

24.500 KD |

- Yes, it can be renewed one month before the expiration date.

- Yes, please visit our head office with the boat registration book (daftar), new insured Civil ID and policy documents.

- The transfer fees are 2 KD.

- Yes, by filling out the application form that requires some necessary information for the boat, such as but not limited to (Make & Model of the boat Year of Build - Value of the boat).

- Yes, please contact 1802080 for more information.