FAY

Protect all these moments that matter.

FAY is a private and flexible medical insurance plan tailored to support your healthcare needs including dental care, maternity expenses, and much more.

Coverage limits ranging from KD 5,000 to KD 1,000,000.

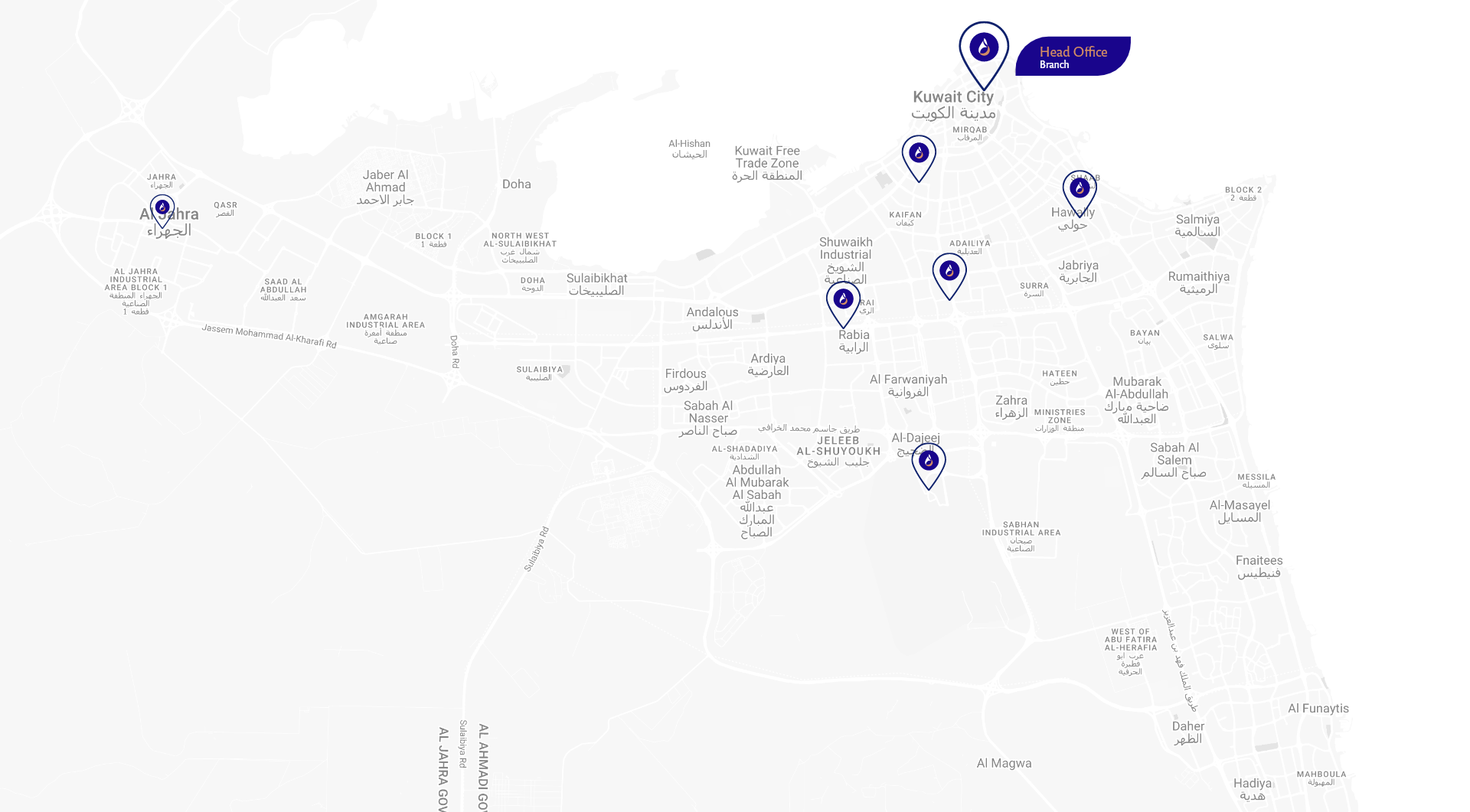

Access to a wide certified medical network.

Optional 10% or 20% or 0% coverage for outpatient services.

Backed by 24/7 technical support from Gulf Insurance Kuwait.

Choose FAY for peace of mind, complete care, and reliable support, anytime, anywhere.

BENEFITS:

| Benefits | FAY | FAY-Plus | FAY-Dual | FAY-Regional |

|---|---|---|---|---|

| Annual Financial Limit |

Option I: KD 5,000 or Option II: KD 10,000

|

KD 100,000

|

KD 200,000

|

KD 500,000

|

|

Territorial Cover

|

Kuwait Only

|

Kuwait Only

|

Kuwait & ( Lebanon or Jordan or India )

|

Kuwait, GCC, MENA, SEA & Turkey

|

|

Medical Network

|

FAY Plus Network

|

FAY Plus Network

|

Dual Network

|

Regional Network

|

|

Age Eligibility

|

|

|

|

|

|

Pre-Existing Conditions

|

Not Covered

|

Not Covered

|

Not Covered

|

Not Covered

|

|

Chronic Medications

|

|

|

|

|

| In-Patient |

Up to Annual Limit (Selected Co-Payment apply)

|

Up to Annual Limit

|

Up to Annual Limit

|

Up to Annual Limit

|

|

Co-Payments Options

|

Nil or 10% or 20%

|

No Co-pay

|

No Co-pay

|

No Co-pay

|

|

Accommodation Type

|

|

|

|

|

|

Hospital Services

|

|

|

|

|

|

Hospital Cash Benefit

|

KD 50 per night A maximum of 30 nights per year

|

KD 50 per night A maximum of 30 nights per year

|

KD 50 per night A maximum of 30 nights per year

|

KD 50 per night A maximum of 30 nights per year

|

|

Parent Accommodation

|

|

|

|

|

| Out-Patient |

Up to KD500/- for KD5,000 plan or KD700/- for KD10,000 plan PPPY

|

Up to Annual Limit

|

Up to Annual Limit

|

Up to Annual Limit

|

|

Co-Payments Options

|

10% or 20%

|

10% or 20%

|

10% or 20%

|

No Co-pay

|

|

Visit Limitation

|

16 Visits per Year

|

16 Visits per Year

|

16 Visits Per year inside Kuwait Unlimited outside Kuwait *

|

Unlimited

|

|

Physician Consultation

|

KD 5 per visit

|

KD 5 per visit

|

KD 5 per visit inside Kuwait No Deductible outside Kuwait*

|

No Deductible

|

|

Diagnostic Tests, Medicines & Physiotherapy

|

10% or 20%

|

10% or 20%

|

10% or 20%

|

No Co-pay

|

| Maternity |

KD 1,200

|

KD 1,200

|

KD 1,500

|

KD 3000

|

|

Waiting Period

|

|

|

|

|

|

Out Patient visits coverage for maternity

|

|

|

|

|

|

Physician Consultation

|

KD 5 per visit

|

KD 5 per visit

|

KD 5 per visit No Deductible outside Kuwait*

|

No Deductible

|

|

Diagnostic Tests & Medicines

|

10% or 20%

|

10% or 20%

|

10% or 20%

|

No Co-pay

|

|

New Born Baby Coverage

|

|

|

|

|

| Dental |

Not covered

|

KD 300

|

KD 400

|

KD 500

|

|

Waiting period

|

Not covered

|

|

|

|

|

Covered services

|

Not covered

|

|

|

|

|

Co-pay

|

Not Covered

|

20%

|

20%

|

20%

|

| Treatment Outside Network (Reimbursement) |

Applicable on all benefits

|

Applicable on all benefits

|

Applicable on all benefits

|

Applicable on all benefits

|

|

Coverage

|

|

|

|

|

- Distinctive coverage including pregnancy and childbirth, physiotherapy, doctor’s consultations, diagnostic tests, prescribed medications and dental care as well.

- Choose programs that cover treatment inside Kuwait only or treatment inside and outside Kuwait, depending on the type of program chosen.

- FAY provides you with full support from a team of specialized medical professionals such as, qualified doctors and nurses available 24 hours, 7 days a week.

- Enjoy coverage of treatment outside of Kuwait within the approved network, with a maximum of 70% of reasonable and accepted fees.

- FAY plans provide you with global emergency services without any maximum limits for as part of in the dual, regional, international, and global plans.

To read the terms and conditions view the policy wording, click here.

Buy your FAY Insurance today and ensure peace of mind!